Events

The Talk Around the Shop: Top 5 Themes from Shoptalk 2016

May 23, 2016

Shoptalk started as a concept several months ago to bring together retailers, innovative disruptors and venture capitalists under one roof to debate, discuss, and explore the retail industry. Over the past three days the concept became a reality, with over 3,000 attendees in a thought-provoking inaugural event.

The retail industry is in a ferocious state of fast-paced change and there is a strong hunger for information, insights and peer-to-peer networking. Shoptalk provided a format to satiate this hunger with on-stage presentations and panel rich discussions coupled with a large social community that produced several thousand handshakes and tweets over the course of the three days.

While there was a great variety of topics discussed, five key themes emerged at Shoptalk 2016.

1. Stores are more relevant than ever.

It wasn’t too long ago that the industry declared stores were dead, but as Jerry Storch, CEO of Hudson Bay Company stated in his event-opening keynote, “The stores strike back”, putting to rest the long-touted (and erroneous) notion that stores don’t matter. Traditional brick and mortar retailers have core competencies, such as merchandising, customer service and logistics that simply cannot be performed optimally online. According to Storch, direct-to-home shipping costs 3x more compared to store-based models — an advantage difficult for pure play retailers to compete with. Stores also provide the place where human connections occur, which still matter to shoppers. We saw example after example of retailers changing the concept of what a store actually is to meet this need. Jerry Fisher, Global Store Experience & VM Director of Luxottica Group, presented how their Sunglass Hut brand has pursued different store formats: pop-up, mall atrium, outside stores and luxury bars; Steven Lowy, Co-CEO of Westfield Corp, discussed how they are re-inventing the mall, blending technology, food, entertainment and leisure; and Brendan Cahill, VP Corporate Projects at Penguin Random House — a publisher who traditionally has relied on retailers to get to market — opened direct-to-consumer concept stores that introduced consumers to new ways to explore paper books.

2. Pure play retail is dead.

Many retailers who have focused purely online have changed their business model, realizing that the distinction between online and offline is an artificial one and is a barrier to the shopping experience consumers truly want. Former pure plays such as Birchbox, Casper and Bonobos spoke about their pop-up and permanent stores, and we’ve seen other pure plays, such as JustFab and Amazon doing the same, with Amazon recently opening stores and expanding their own private label product offerings to connect more directly with consumers. As Bonobos CEO Andy Dunn explained, “our guide shops are not a store but a great customer experience.” Digitally native vertical brands like Bonobos, Casper, and Warby Parker are all upending the traditional definition of what an in-store experience can mean for consumers.

3. Digitization of the store is coming of age.

Just a few short years ago, very few retailers were driving digital into the store. This was simply due to the fact that it was (and still is) challenging, expensive and often didn’t demonstrate the necessary ROI to justify the investment. And the retailers that were digitizing the store tended to be larger retailers with deeper pockets, who were focused on solving simpler problems, such as connecting consumer-held mobile experiences to in-store shopping and extending web-inventory into an endless aisle in the store. Fast forward a few years and we’re seeing retailers of all sizes driving innovation into the store, not only solving real problems, but demonstrating real ROI. Perhaps the best example of this is Rebecca Minkoff, who has made the embrace of digital core to their business model. From digital mirrors that allow for suggested accessories to outfits being tried on in the fitting room to empowered store associates who use clienteling to personalize in-store consumer interactions, Rebecca Minkoff has seen in-store basket sizes increase three fold, according to Uri Minkoff, co-founder and CEO of Rebecca Minkoff.

4. Artificial intelligence is on the rise.

While artificial intelligence conjures up futuristic scenes from the Minority Report or Terminator, it was featured as an important topic in retail today at Shoptalk. It’s still early on, however, and artificial intelligence will evolve from existing technologies that are impacting retail in the present day, particularly predictive intelligence and machine-learning, to allow retailers to benefit from a more complete view of the shopper. We also expect to see “shopperbots” (chatbots 2.0) rise as improvements in natural language processing converge with a millennial desire to use messaging platforms to communicate with brands. Identity, behavior and location will drive context, as will shopper-supplied natural language queries, giving retailers an opportunity to render smarter results. Sailthru Founder, Neil Capel, spoke of how Country Outfitter leverages predictive intelligence today to understand which of Country Outfitter’s shoppers are likely to purchase and in what timeframe, providing more focus to their marketing efforts, but also more relevant, personalized experiences to their shoppers, resulting in a 70% increase in revenue. Retailers such as Country Outfitter, who embrace predictive intelligence, are best prepared to innovate and reap the results of artificial intelligence as it emerges.

5. Authenticity matters in retail more than ever.

With all the noise in the market, consumers are demanding authenticity, meaning a desire to truly understand what the brand stands for and hold them accountable for it in the products they deliver. The brands that are able to make their mission well-understood and connect with the story of the consumers’ lives are the ones that will differentiate and win. We saw this from Dollar Shave Club, who has connected with men whose grooming needs have long been ignored to The Honest Company who make it their mission to provide safe, effective home essentials, and to REVOLVE Clothing, who has built a $400m business over the past 13 years, by making female Millennials feel empowered through fashion.

These themes resonate strongly with Marigold Engage by Sailthru since we’ve invested heavily in a comprehensive set of capabilities in a single platform that allow retailers to build deeper, longer lasting relationships with consumers. Creating authentic, consistent and personalized experiences across all touchpoints — email, web, mobile, social and in-store — are critical in the ever-changing world of retail, and we’ve invested not just in email, but also in cross-channel personalization and predictive intelligence, centered on information gathered in real-time about the consumer — both implicit and explicit — collected across all points in the retail enterprise. Read about how leading retailers like Everlane and Betabrand grow revenue with Marigold Engage by Sailthru.

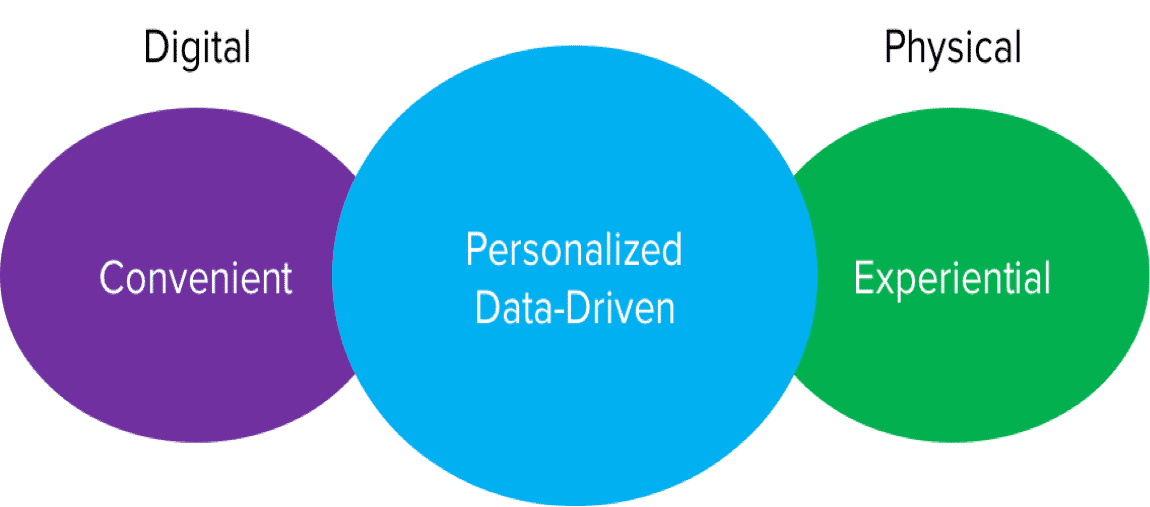

Shoptalk could perhaps best be summed up by a graphic that appeared during a presentation on day two:

The convergence of the digital world with the physical world will be personalized and data-driven, just as Target’s Chief Strategy and Innovation Officer Casey Carl shared during his interview by Hilary Milnes from Digiday: “A one-to-one personalized experience is our aspiration.”

Shoptalk put itself on the map with this event. They laid down a solid foundation of content and a lively, connected community from which they will be able to build in the future and achieve their goal of reshaping how consumers discover, shop, buy, and remain loyal.

— Gary Lombardo, VP of Demand Generation and Product Marketing

The State of Brand Loyalty in the U.S. in 2023

Related