Retail

How Luxury Brands Are Increasingly Embracing Ecommerce

October 2, 2019

“Is Digital Killing the Luxury Brand?” asked a September Adweek headline. The article focused on luxury retailers’ reluctance to embrace digital, concerned that their exclusivity could be compromised by the Internet’s inherent accessibility.

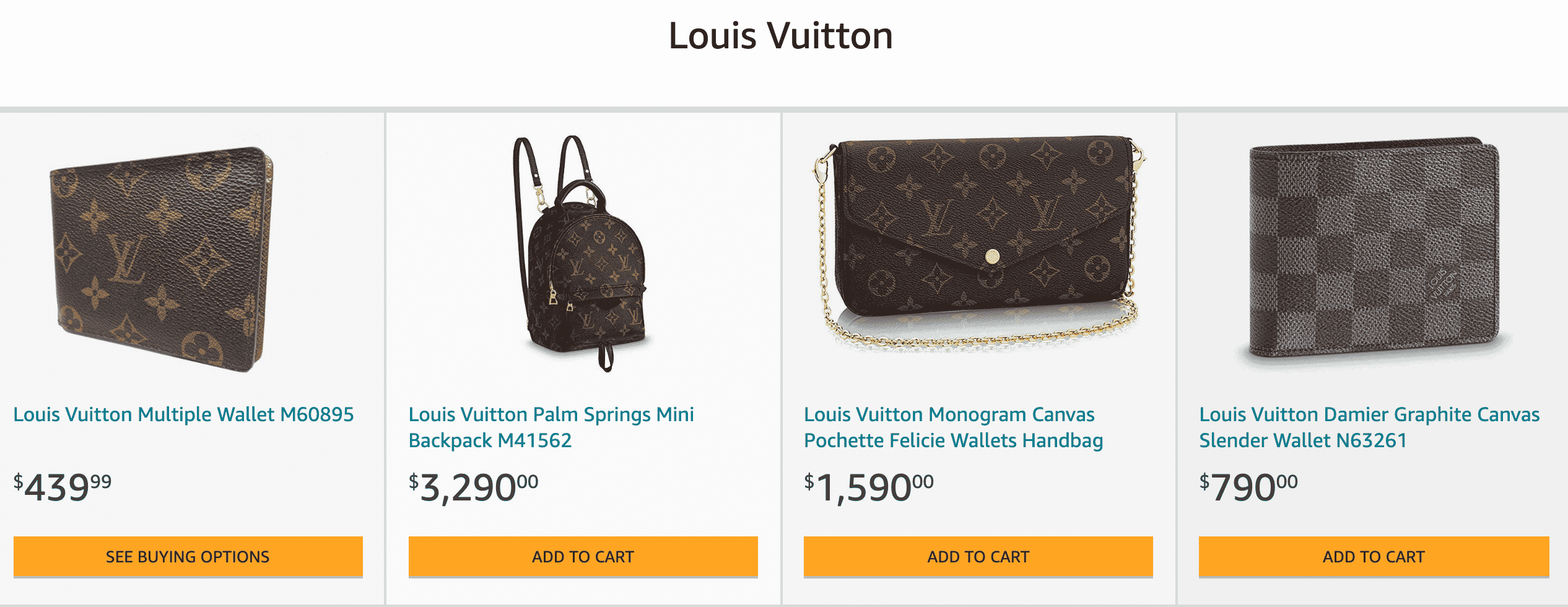

Oh, that headline was from September 2011. Since then, the luxury landscape has changed quite a bit. Gucci allocated more than half its advertising to digital channels last year. Louis Vuitton, Chanel and Tiffany & Co. are all available on Amazon.

For luxury brands, it’s always been about brick-and-mortar. Physical stores allow the brands to roll out the red carpet and deliver white glove service to customers, while also maintaining full control over the customer experience. But over time, luxury players have had no choice but to move online alongside their customers.

How Luxury Players Improved Personalization

Over the past five years, luxury brands have outpaced the global market in ecommerce growth. McKinsey & Company projects that ecommerce will make up 19% of the luxury market by 2025, up from 9% last year.

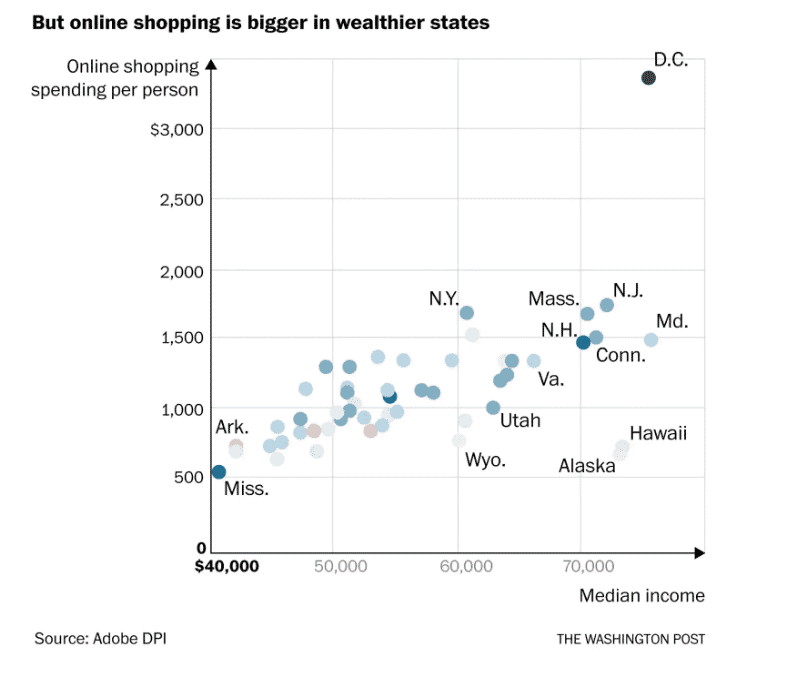

It makes sense when you think about who buys these brands. With the exception of Alaska and Hawaii, whose isolated geography often incurs additional shipping fees, there’s a strong correlation between the states that shop online the most and the states with the highest per capita income.

As luxury retailers increasingly embrace ecommerce, we’ve seen a huge improvement in their capabilities since we launched the inaugural Retail Personalization Index two years ago. Early on, brands like Nordstrom and MATCHESFASHION were anomalies; most of their high-end contemporaries fell much further down the list.

In the third annual Index, Nordstrom was the runner-up while Rent the Runway came in third. Joining them in the top 25 were Revolve, The RealReal, MATCHESFASHION and Saks Fifth Avenue, which had one of the strongest comebacks from last year.

Looking at the Luxury Landscape’s Future

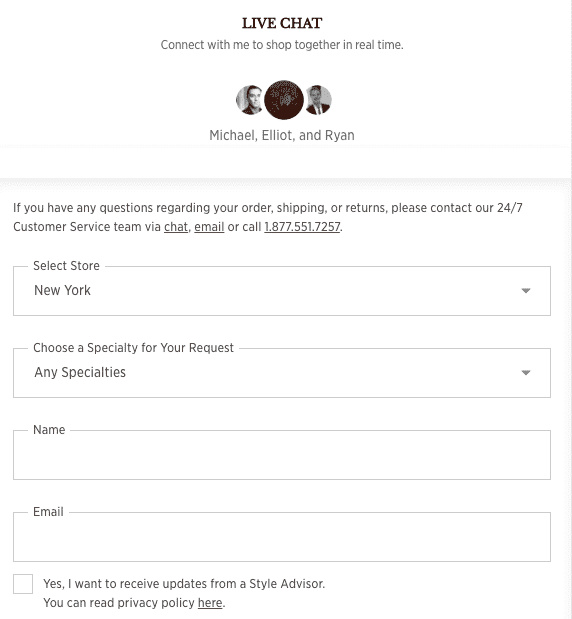

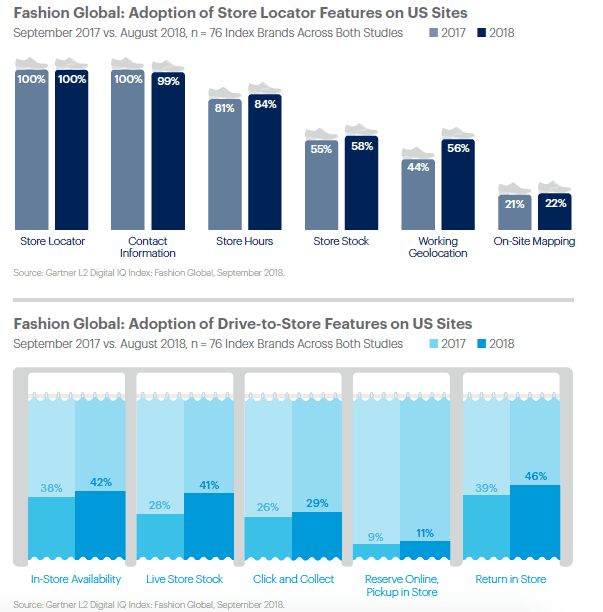

It’s not just us. Analyzing 76 luxury retailers last year, Gartner’s L2 research firm found that most of luxury brands’ web traffic comes from search. That means that consumers aren’t necessarily heading to Chanel.com, as much as they’re coming across it in their research. L2 also noted how much these retailers’ websites have improved year-over-year in various categories, including geolocation and real-time inventory.

From year to year, onsite personalization is where we’ve seen the most marked improvement for luxury brands. Retailers could earn 26 possible points in that category; the average score was 12.6. Meanwhile, Rent the Runway and MATCHESFASHION earned 22 and 21 points apiece there, two of the highest site scores on the Index.

Luxury consumers are shopping online more than ever and brands are accommodating them. However, the majority of sales still happen in physical stores. Mobile devices are the key to in-store personalization. Email, the most lucrative digital marketing channel, is a great way to drive traffic to stores.

To stay competitive, high-end retailers must give their mobile and email experiences the same TLC as their websites. Each edition of the Retail Personalization Index shows they are; we’re excited to see more improvement in the future.

The State of Brand Loyalty in the U.S. in 2023

Related