Article

How Personalization Gives Savvy Retailers an Edge Over Amazon

October 17, 2019

Everyone knows that Amazon is a retail and technology powerhouse. Its loyalty program boasts more than 100 million members and after a few short years, Prime Day rivals Black Friday and Cyber Monday. Accounting for nearly half the ecommerce sales in the U.S., Amazon is also the world’s largest retailer as of May.

Many retailers set strategies specifically assuming that they either will or will not compete against Amazon. But given how much Amazon has diversified in the past few years, it only makes sense for retailers to figure that even if they’re not directly competing against Amazon today, they will be very soon.

But how, exactly, given Amazon’s size and scope, can they hope to do that?

That’s just one of the interesting questions we are able to answer — at least in part — with Marigold Engage by Sailthru’s Retail Personalization Index. In its third year, the Index is the result of exhaustive research into how different retailers are personalizing their communications with customers, and to what end. Originally in 17th place, Amazon has since dropped to 56th.

It’s not that Amazon’s personalization has gotten worse; other retailers have simply gotten better. Despite the promises of low prices and free shipping, there are plenty of places where Amazon seems to be missing out on occasions to improve the customer experience — and where other brands sense opportunity.

The Power of Product and Personalization

The key to understanding and competing with Amazon is acknowledging that Amazon doesn’t care what its customers buy. They want just them to buy it through Amazon. As a result, Amazon rarely communicates with its customers in anything other than a transactional context. Even the email that Amazon does send – such as its Deal of the Day – isn’t particularly personalized. In fact, the company scored zero points in the email category.

Meanwhile, its competitors are using digital communications to nudge customers toward loyalty programs. They’re using email and mobile to welcome their customers on board, to deliver compelling content, to help solve their customers’ problems, or simply to enable them get the most out of their experience with the brand. In some cases, they’re capitalizing on a network of brick-and-mortar stores.

Successful retailers are also using their unique domain expertise and knowledge of their customer to come up with solutions that customers love. Amazon may believe these sorts of solutions won’t scale in their environment. They may also think that product-centric initiatives are a waste of time (because they don’t care which products a customer buys). But we’ve found that, for many retailers, there are many other strategies working. Here’s are three examples:

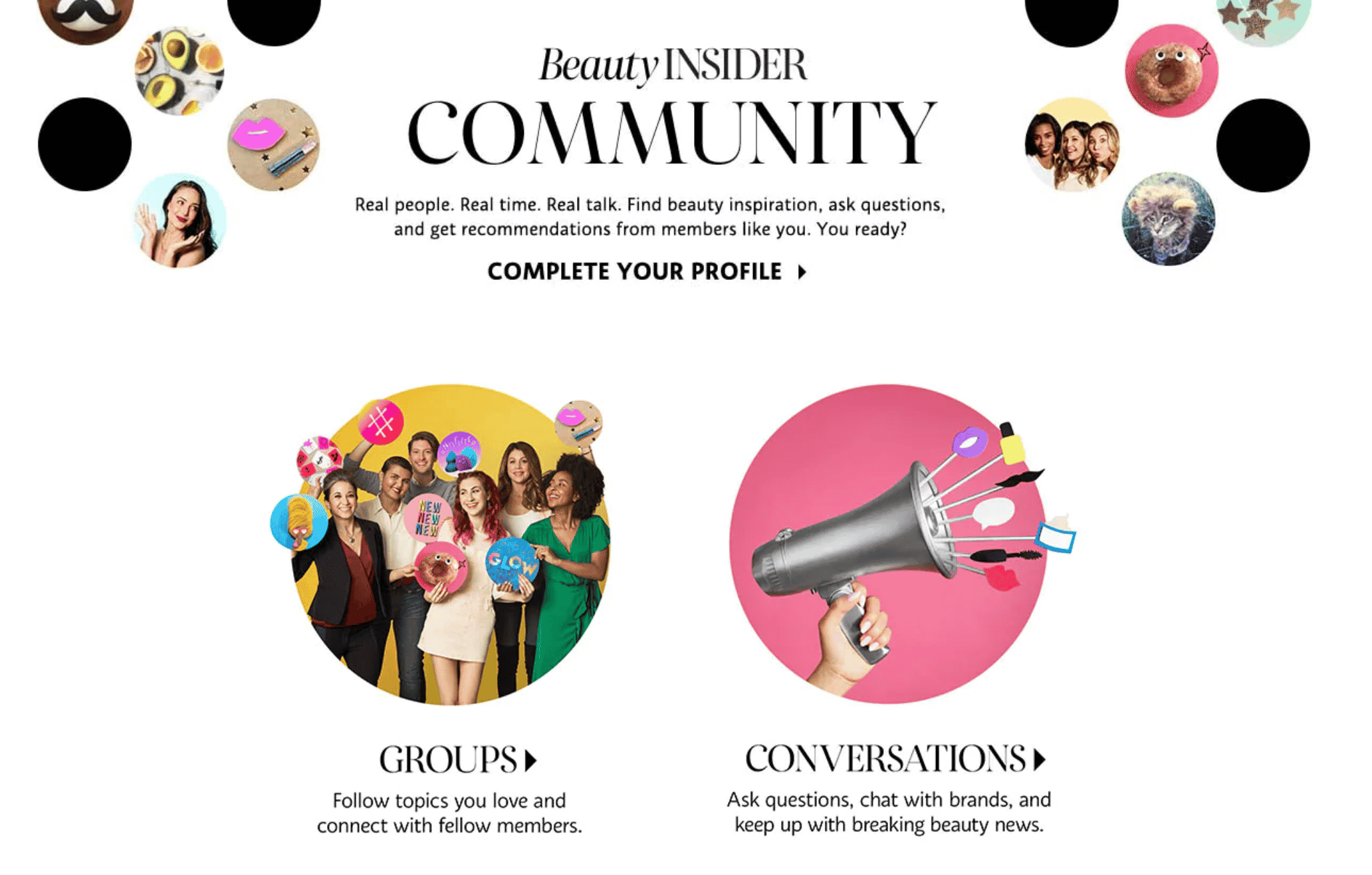

Sephora (first place)

Sephora is building a superior customer experience by fostering an active community on its site. Sephora members are quick to help other shoppers choose the products most suitable to them and figure out how to use them. Amazon, by contrast, doesn’t have any particular community on its site. It hosts a massive number of reviews, but those don’t generate a sense of community, especially given the increasing prominence of paid reviews. Sephora also uses its email and digital channels to convince customers to visit stores for consultations. That’s not something Amazon will be able to match for some time.

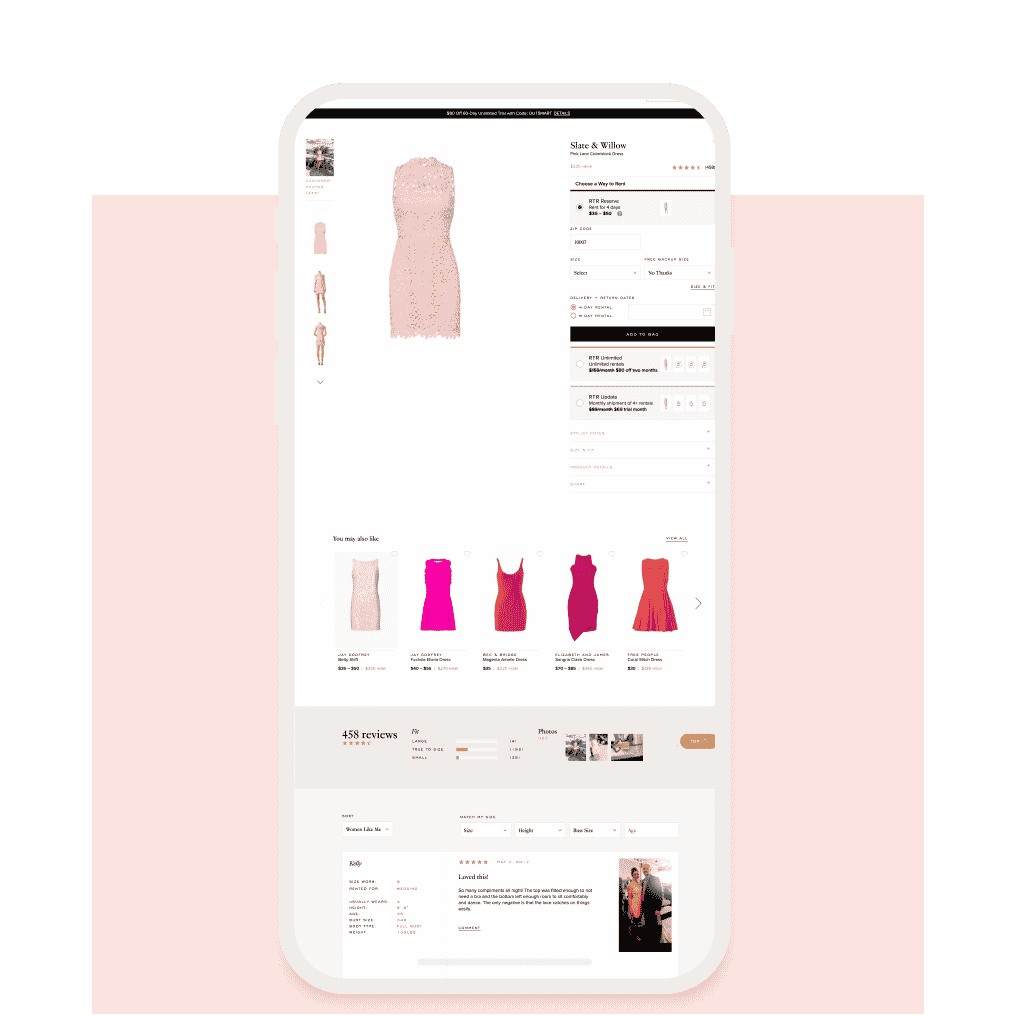

Rent the Runway (third place)

Many Rent the Runway customers use the service for special-occasion clothes. So Rent the Runway asks each customer to provide a back-up size, reasoning that if an item is ordered for a big event and doesn’t fit, there probably won’t be time to swap it out for another. Rent the Runway also asks its customers which parts of their body are hardest to fit, which helps the brand make better recommendations. You can bet the Rent the Runway customer feels that they’re getting more out of their experience with Rent the Runway than the Amazon customer does out of buying apparel on Amazon.

Best Buy (fifth place)

Best Buy is succeeding against Amazon partly because Best Buy understands that buying a television online can be just awful. Even if you want to buy a tv online, you’re probably going to at least visit a store to compare the quality of the images. No one wants an expensive television just sitting on their front step, waiting for them to come home. And because not everyone has the patience or ability to get a smart TV working perfectly, Best Buy has a service that will come and install it. Suddenly, it’s hard to rationalize buying a spiffy new television through Amazon.

If there’s one lesson to be learned from comparing online retailers, it’s that every one has to find its own strategy to successfully compete. That strategy must also be firmly rooted in its own superior knowledge of their customers and loyalists.

Amazon, has, essentially, provided a one-size-fits-all solution for online shopping.

But now, thanks to personalization, one-size no longer has to fit everybody. Each individual can have their own size, perfectly tailored to their wants and needs. For retailers, that’s a huge opportunity waiting to be seized.

The State of Brand Loyalty in the U.S. in 2023

Related